FinTech Research Team

|

|

|

|

|

|

| Simon Alfano | Daniel Drummer |

Stefan Feuerriegel |

Joscha Märkle-Huß | Nicolas Pröllochs | Prof. Dr. Dirk Neumann Lehrstuhlinhaber |

Kontakt: tonality@is.uni-freiburg.de

Our Research

Prof. Dr. Dirk Neumann and his team can recourse to more than 10 years of active research in the space of financial technology space (see below for a selection of previous projects).

Research Topics

Current research topics in the Fintech space include:

- Peer-to-peer/market place lending

- Blockchain technology

- Payment analytics and big data

Organization of FinanceCom

The Chair for Information Systems Research has been selected to host the prestigious 2016 FinanceCom in Frankfurt. After very successful FinanceCom workshops in Sydney, Regensburg, Montreal, Paris, Frankfurt and Barcelona, FinanceCom 2016 will be returning to Frankfurt on 8th December 2016. Advancements in Information and Communication Technologies have paved the way to new business models, markets, networks, services, and players in the Fintech industry.

http://www.financecom2016.is.uni-freiburg.de

Industry Cooperation

The Chair of Information Systems is also involved in high profile cooperations with companies from the Fintech industry, nationally and internationally.

For more information please reach out to fintech@is.uni-freiburg.de

Project: Dictionary Generation for Financial News

| Aims |

|

| Method |

|

| Results |

|

Pröllochs N, Feuerriegel S, Neumann D: Generating Domain-Specific Dictionaries Using Bayesian Learning, 23rd European Conference on Information Systems (ECIS 2015), Münster, Germany, May 26-29, 2015.

Pröllochs N, Feuerriegel S, Neumann D: Say it Right – How Managers Prettify Corporate Disclosures 2015 (Winter Conference on Business Intelligence (WCBI 2015), Snowbird, Utah, 12-14 March 2015.

Pröllochs N, Feuerriegel S, Neumann D: Is Human Information Processing Affected by Emotional and Cognitive Biases? Evidence from the Stock Market, Working Paper, University of Freiburg, 2015.

Project: Information Processing of Initial Public Offering Filings

| Aims |

|

| Method |

|

| Results |

|

Feuerriegel S, Schmitz J T, Pröllochs N, Neumann D: What Matters Most? How Tone in Initial Public Offering Filings and Pre-IPO News Influences Stock Market Returns What Matters Most? How Tone in Initial Public Offering Filings and Pre-IPO News Influences Stock Market Returns 2015 (2015 FMA European Conference, Venice, Italy, June 11-12, 2015.

Feuerriegel S, Schmitz J T, Neumann D: What Matters Most? How Tone in Initial Public Offering Filings and Pre-IPO News Influences Stock Market Returns, Working Paper, University of Freiburg, 2014.

Project: News Reception in Accordance with the Noise Trader Theory

| Aims |

|

| Method |

|

| Results |

|

Alfano S, Feuerriegel S, Neumann D: Is News Sentiment More than Just Noise?, 23rd European Conference on Information Systems (ECIS 2015), Münster, Germany, May 26-29, 2015.

Alfano S, Feuerriegel S, Neumann D: Do Pessimists Move Asset Prices? Evidence from Applying Prospect Theory to News Sentiment, Working Paper, University of Freiburg 2015.

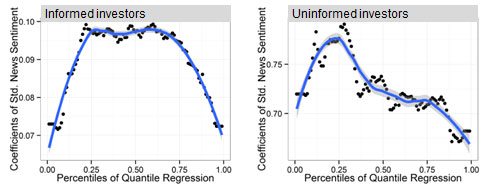

Project: Asymmetric Information Processing of Financial News Sentiment

| Aims |

|

| Method |

|

| Results |

|